charitable gift annuity tax reporting

If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined. Gift tax reporting is required for gifts to charities of remainder and lead interests.

Charitable Gift Annuity Deferred University Of Virginia School Of Law

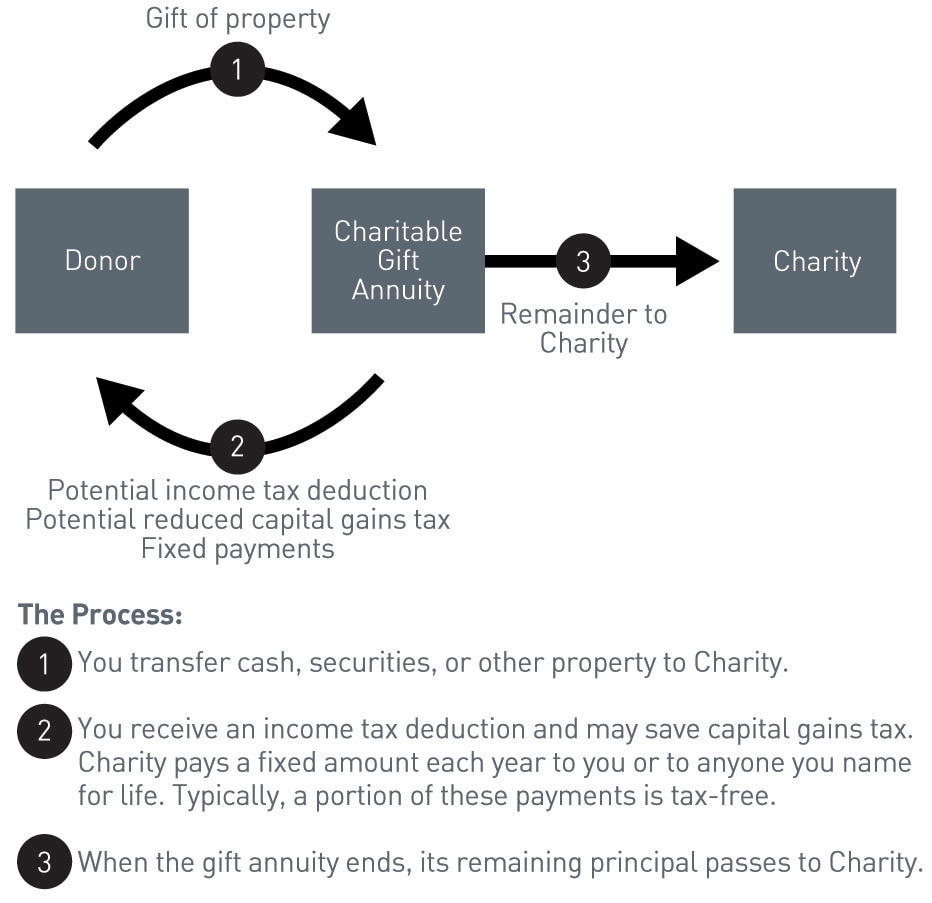

You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid for the gift annuity.

. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. A charitable gift annuity is a contract between a donor and a charity with the following terms. Under that contract the donor gives cash or other.

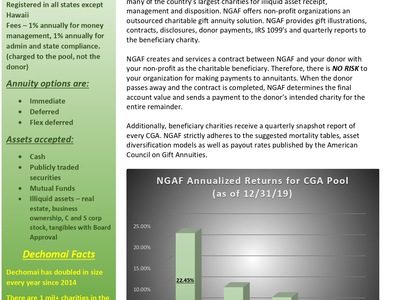

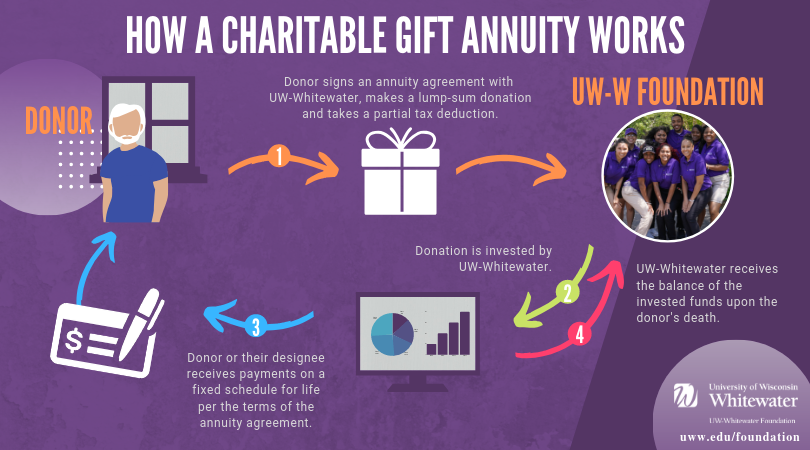

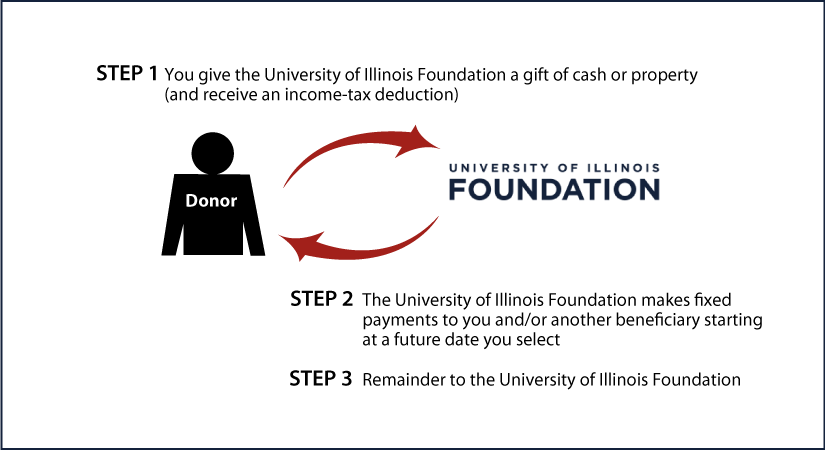

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. A charitable gift annuity is a form of planned giving that is set up by way of a contract between a donor and a specific charity. WHAT IS A CHARITABLE GIFT.

With a cash donation your. Once you have answered all the questions. A lifetime gift reduces estate taxes as effectively as a bequest but has the added benefit of providing gift recognition during the donors lifetime.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. The minimum required gift for a charitable gift annuity is 10000. If a donor makes a gift of cash to fund a gift annuity a portion of each distribution from the annuity is taxed as ordinary income and a portion of the annuity is a tax-free return of.

Section A can be completed by you or your tax return preparer. A charitable gift annuity is a type of donation that allows you to give back to your favorite charity and receive payments in return. However the donor must report the gift if it exceeds the 13000.

You get an immediate charitable tax deduction in the year of your gift usually between 25 and 55 of the amount you transfer to charity. Section Athe simpler part of the formis used to report gifts valued at 5000 or under. The amount reported as a deduction on your Form 8283 should not be the full amount of the appreciated stock you gave to the charity.

The value of the charitable gift element of a deferred payment gift annuity is deemed a present interest. That makes sense when you consider only part of the gift annuity is a gift to your. 2 A gift tax charitable deduction will be allowable under 2522a when Taxpayer purchases the charitable gift annuity pursuant to the Agreement from Charity and 2522c.

This is because with a charitable gift. It is a great way to support a cause that is important to you. It is a contract with a charitable organization for a stream of payments in a fixed amount payable in annual or other more frequent installments over.

In exchange the charity assumes a legal. What is a charitable gift annuity. Offsetting gift tax charitable deductions are available for those gifts resulting in a wash.

As a donor you make a sizable gift to charity using cash securities or possibly other assets. Initial funding may be as little as 5000 though they tend to be much larger. Please contact the administrator of your charitable annuity to determine if any of the capital gain should be reported in this section.

A charitable gift annuity may be funded with cash securities or a variety of other assets.

Charitable Gift Annuities Uses Selling Regulations

Net Proceeds Charitable Gift Annuity Claremont Mckenna College

The Law And Taxation Of Charitable Gift Planning An Online Series Marketsmart

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuities Everence Faith Based Financial Services

University Of Illinois Foundation Gift Planning Deferred Payment Gift Annuity

Taxation Of Charitable Gift Annuities

Charitable Gift Annuity At Greater Worcester Community Foundation

City Of Hope Planned Giving Annuity

Charitable Gift Annuity Claremont Mckenna College

Planned Giving Del Oro Division

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Charitable Gift Annuity Giving To St Lawrence

National Gift Annuity Foundation Guidestar Profile

Pet Therapy Charitable Gift Annuity Lifelong Pet Care